-

**Decals on Wheels: Crafting with Cricut Heels**

This blog post recounts the author’s experience using the Cricut Starter Kit for the first time, in order to create a custom car decal. They delve into the step-by-step process from setting up the kit, designing the decal, cutting the vinyl, and applying the design onto the car. Despite initial challenges and a learning curve,…

-

Deep-Diving into Stripe's Payment Ecosystem

Deep-Diving into Stripe's Payment Ecosystem Stripe has carved a niche for itself as a powerhouse in global payments and revenue management. For those with a keen understanding of the fintech landscape, the architecture of Stripe’s services offers a nuanced view of its strategic breadth across multiple payment stages and business models. At its core, Stripe…

-

Tech Talent Solutions: Revolutionizing Recruitment for Business Growth

“Revolutionizing recruitment in the tech industry can lead to significant business growth. By tapping into a diverse pool of talented professionals and offering tailored recruitment solutions, companies can drive innovation and success. Are you maximizing your recruitment strategies to unlock your business’s full potential?”

-

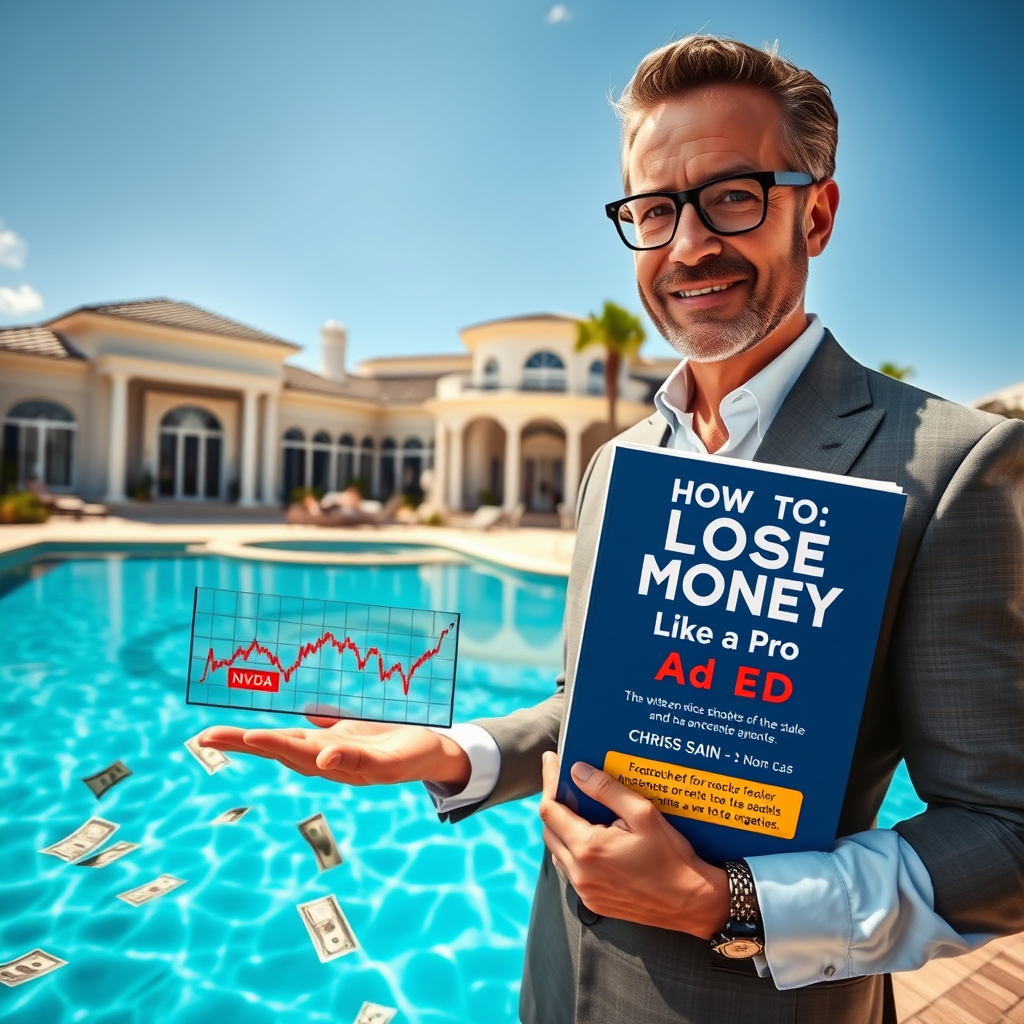

How to Lose Money Like a Pro: Chris Sain’s Guide to NVDA Stock Swimming Tips!

The blog post covers a YouTube video by Chris Sain titled EMERGENCY NVDA Stock Update {Do This ASAP} where he discusses the recent sharp drop in Nvidia (NVDA) stock price and how investors can manipulate this to their advantage. The video, which was posted on January 27, 2025, emphasizes the importance of being prepared and…

-

Navigating Stock Market Volatility: Insights on Nvidia, AMD, and Select Investment Strategies

In his latest video, Jeremy from Financial Education delivers a detailed analysis of Nvidia’s substantial stock drop due to concerns about future GPU demand amidst the advancements of Chinese AI firm, Deep Seek. He speculates on the consequences this could have on Nvidia’s future and questions the sustainability of its high price-to-sales ratio. Jeremy shares…

-

How to Turn $1K into $1M by Buying Chips and Praying – Stock Picks That Won’t Make You Cry!

This blog post summarizes the YouTube video 4 High-Potential Stocks to Turn $1000 into $1 Million by ZipTrader’s Charlie. The video highlights four promising stocks, namely ARM Holdings, SoFi Technologies, Tempest AI, and Palantir Technologies. For each stock, Charlie explains their sector, potential for growth and specific trading strategies for maximum gain. Furthermore, he briefly…

backslash.cash

get rich on the internetz

Follow Me On Instagram

@WillamSmith