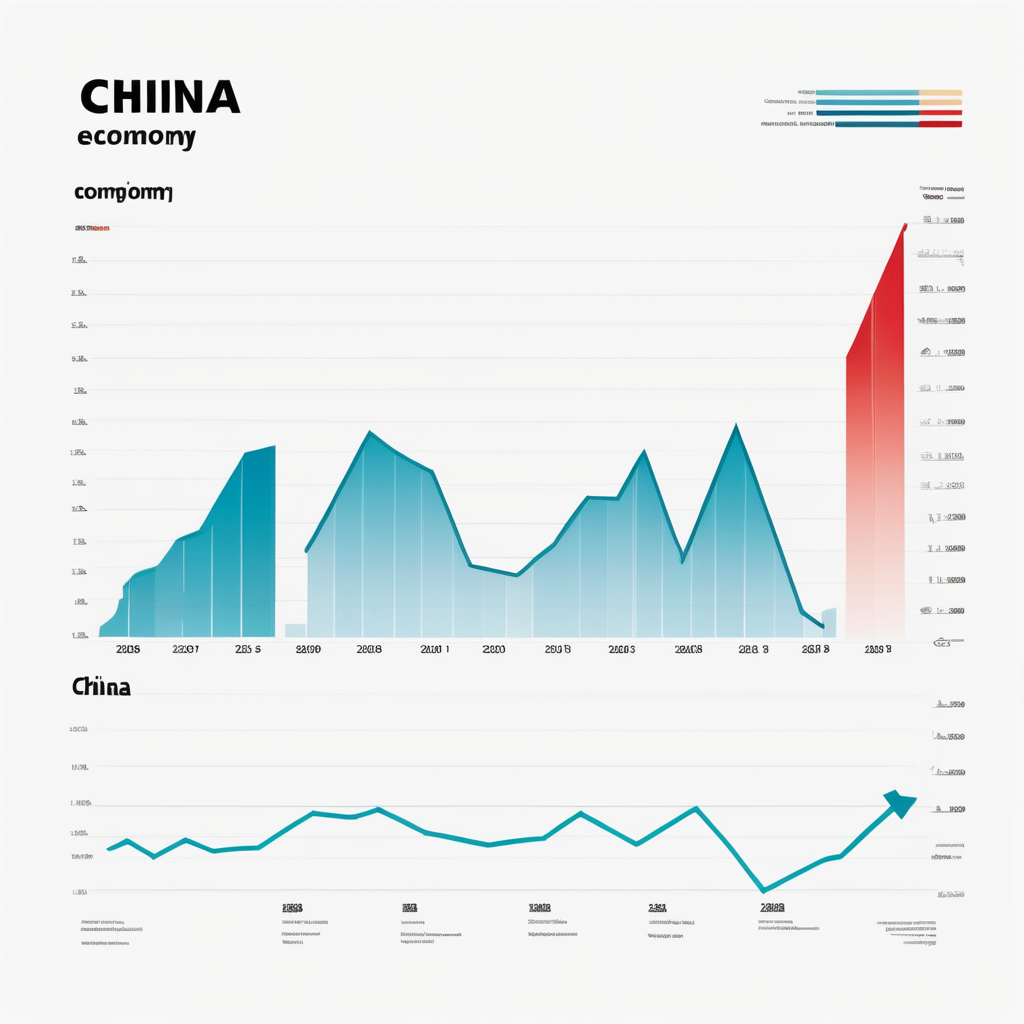

China’s Economic Maze: Unraveling the Haze

This article provides an in-depth look at the current economic challenges China is facing, including high unemployment rates, decreasing real GDP, and low consumer confidence. It dives into each issue, describing what has led to these situations, and what impact they are having on both China’s economy and the global market. Additionally, the piece covers the rising debt-to-GDP ratio, problems in the housing market, the impact of lockdowns on the economy, and more. To conclude, it provides potential solutions and actionable insights to tackle these challenges.

Read more